eGovernment

>> Saturday, July 11, 2009

Malaysian government has identified initiatives to implement the modernization of the public sector. MSC is Malaysia’s initiative for the global information and communication technology (ICT) industry. The e-Government initiative was launched in Malaysia in the year 1997 by the former Malaysian Prime Minister, Tun Dr Mahathir Mohamad as one of the seven flagships of the Multimedia Super Corridor (MSC) initiative. The e-Government initiative focuses on increasing efficiency and at the same time reducing operational costs of public services offered. All government agencies will be equipped to quick start to offer public services through e-Government if there is a standardized framework for guidance.

The current applications of e-government in Malaysia such as e-Filling, Renewing Road Tax and Driving License Online, KWSP’s i-Akaun and E-Perolehan. Nowadays, we can renew road tax and motor insurance policy at http://www.myeg.com.my/. It also provides a list of about 100 insurances companies for citizen to choose it. In addition, we also can renew driving licenses and pay or check traffic summonses through the online at http://www.jpj.gov.my/.

However, many citizens in Malaysia do not use e-government because they are lack of computer knowledge. Besides that, the languages available of e-government applications are more on English and Malay. Some consumers are not proficient in those languages, so they are rarely using the e-government applications.

Citizen’s adoption strategies

The government should be able to propose an effective strategy to encourage citizen’s adoption of e-government by focusing on these 4 areas.

1. Customer satisfaction

E-Government adoption requires that citizens show higher levels of satisfaction with the online service provided by the government. A higher level of customer satisfaction will increase the rate of e-Government adoption.

2. Service Quality

Online service quality for e-Government could be measured in terms of quality of content provided on the website, the speed of the response to the citizens concerns with problem solving approach, and the availability of names. Other important measurement factors are telephone and fax numbers of personnel with whom citizens might need to get in touch, and the integration of an offline channel with online channel so that citizens could interact with government departments through other means if necessary. Higher quality of service will lead to higher levels of customer satisfaction and thus can increase the use of e-government services.

3. Website Design

Personalization of websites, customization of product offerings, and self-care are the three key features that could be used not only to build relationship with the visitors, but also to enhance their experience. These features give visitors a sense of control and participation and could potentially enhance their adoption

4. User Characteristic

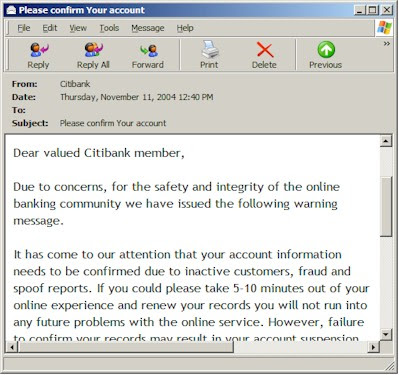

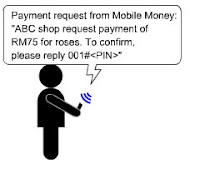

User characteristics such as perceived risk, perceived control, and internet experience can have a direct impact on internet adoption. Experience influences a citizen’s trust of e-Government. Users with prior experience, especially if satisfied, would be more likely to return to use e-Government services. Perceived risk leads to security and privacy issues that could discourage the use of online services. It is important to ensure that citizens can transact online securely and their personal information will be kept confidential to increase the level of trust and the e-government adoption rate.

However, there are still a few disadvantages in e-learning The major

However, there are still a few disadvantages in e-learning The major

(a)

(a)