mobile payment system

>> Thursday, July 2, 2009

A mobile payment or m-payment may be defined, for our purposes, as any payment where a mobile device is used to initiate, authorize and confirm an exchange of financial value in return for goods and services. Mobile devices may include mobile phones, PDAs, wireless tablets and any other device that connect to mobile telecommunication network and make it possible for payments to be made. The realization of mobile payments will make possible new and unforeseen ways of convenience and commerce. It has also been popular in Malaysia.

Mobile Money is a PIN-based Mobile Payment Solution to address the limitations and bottlenecks created by cash, cheques and credit cards. It only allows registered users to pay for goods and services at anytime, anywhere using only a mobile phone coupled with a 6-digit security PIN via SMS. This gives the freedom to shoppers to buy products online and pay the merchant using his/her mobile phone without being physically present at the store.

Mobile Money International Sdn Bhd is one of the biggest mobile payment service providers in Malaysia. Mr. Lee Eng Sia sees the opportunity and potential of mobile money and thus initiated the idea of mobile payment system introduced in Malaysia. Its objective is to provide Merchants and consumers with a convenient and secure Mobile Payment and Mobile Commerce platform.

The introduction of mobile money has benefited both participating merchants and consumers. The merchant can now sell to people across town, across the country and take payment around the clock, which is not possible with current payment systems. Online selling (e-commerce) becomes a practical means for merchants since customers will only need to enter their mobile phone during checkout from merchant e-commerce website. With Mobile Money, merchants do not have to be concern of cash /cheque/credit card handling problems or fraud. The Mobile Money Payment System conforms to the stringent requirements set by Bank Negara Malaysia and the participating banks. Furthermore, consumers don't need to have a merchant account to apply for Mobile Money, consumers’ existing bank account will suffice. It will easily save them RM50,000 which they need to deposit in their merchant account with banks. On the other hand, consumers who use mobile money service are able to enjoy the convenience to pay anyone, including to any bank accounts from anywhere, at anytime. You can pay various bills and your loan repayments at home. With its advantage, consumer can start to buy and save from participating mobile commerce platform.

In addition, it can function like a credit card if a consumer applies for a “Pay by Mobile Phone” credit card account. Therefore, the consumer will be billed by the bank by month’s end. Alternatively, it can function as a Debit Card if the consumer applies for savings or current account. The amounted consumed will be deducted directly from the account upon successful transaction.

How it works

1. Customer That Purchase Online from an E-commerce Website

2. Pay by Mobile Phone Number(Applies to customer purchase from merchant's brick-and-mortar store or Remote Payment)

1. Customers choose to pay via Mobile Money for the goods and services from participating merchants.

Customer gives merchant his/her mobile number via phone, fax, email etc.

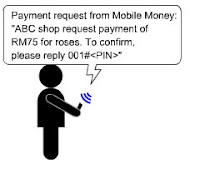

2. Merchant can bill the customer via IVR, Mobile Money website or SMS. When merchant requests for payment with customer's mobile number, Mobile Money sends an SMS with a Bill Reference Number to customer requesting customer to to reply with their 6-Digit Security PIN to approve the payment.

3. Customer authorizes payment by replying the SMS with the Bill Reference Number and customer's 6-digit SECURITY PIN.Mobile Money authenticates customer's SECURITY PIN and requests for bank approval on transaction.

(In this illustration, 001 is the Bill Reference Number while 123456 is the security PIN. In simpler terms, 001 means it is the 1'st SMS request for payment, 002 means the 2'nd, 003 means the 3'rd and the number increases. )

4. upon receipt of bank's confirmation to debit customer's mobile credit account or mobile Debit account, Mobile Money will send a payment notification with details to merchant as well as customer.

5. Merchant can deliver the goods / services.

0 comments:

Post a Comment